This Week in Compliance Vol. 1

What's on the compliance radar this week? Here's a summary of notable insights and news unfolding in the regulatory arena.

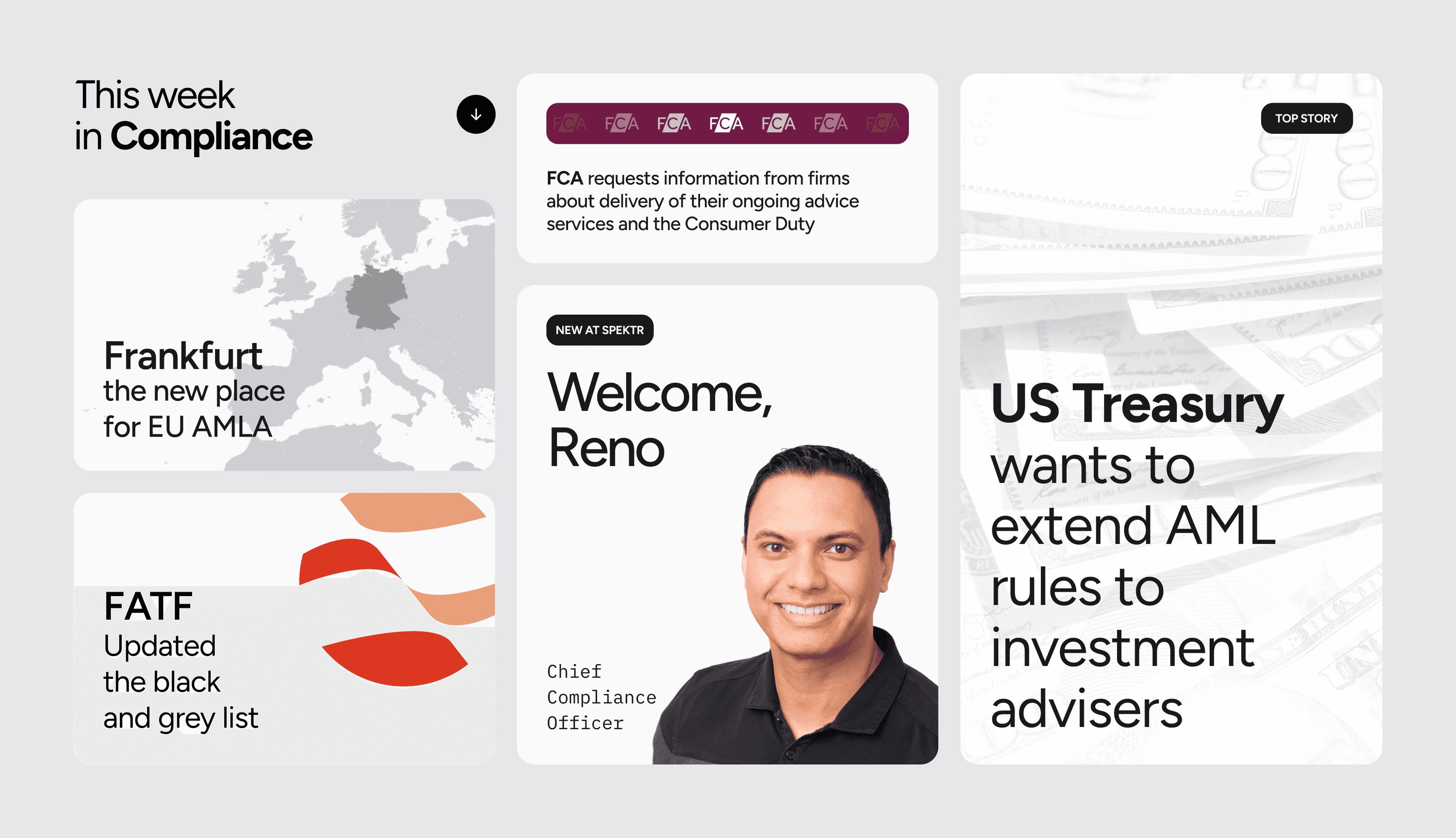

Reno Mathews, former executive at Citi, Google and Meta, joins spektr

Reno Mathews joins spektr our first Chief Compliance Officer. With over 20 years of experience at major organizations like Citi, Google, Robinhood, and Meta, Reno brings unparalleled expertise to our team.

His track record includes leading compliance controls globally and collaborating with regulatory bodies across multiple jurisdictions. Reno's focus on leveraging technology and automation aligns perfectly with our mission to simplify ongoing due diligence processes for our clients.

FATF updated the black and grey list

The FATF Plenary in February 2024 focused on several key initiatives:

- Issued new guidance for Recommendation on beneficial ownership transparency.

- Proposed amendments to Recommendation of concerning wire transfers.

- Enhanced measures against money laundering and terrorist financing in the virtual asset sector.

- Updated lists of high-risk and monitored jurisdictions.

- Appointment of a new FATF President for the 2024-2026 term.

Frankfurt is the new place for EU AMLA.

Frankfurt has been chosen as the host city for the European Union's Anti-Money Laundering Authority (AMLA), a cornerstone in reforming the European Union’s anti-money laundering framework.

AMLA is endowed with both direct and indirect supervisory powers over obliged entities, highlighting its active role in regulatory oversight within the financial sector.

This new central body is empowered to enforce sanctions and take action, facilitating the harmonization of AML regulations among EU member states and ensuring more effective and consistent application of anti-money laundering regulations across the EU.

FCA requests information from firms about delivery of their ongoing advice services and the Consumer Duty

The Financial Conduct Authority (FCA) is requesting information from financial advisory firms about the delivery of their ongoing advice services in relation to the Consumer Duty. This initiative is part of the FCA’s commitment to embed the Consumer Duty's principles.

The FCA's focus is to ensure that firms not only act with integrity but also proactively avoid causing foreseeable harm to their clients while enhancing their financial wellbeing and supporting their financial objectives.

US Treasury wants to extend AML rules to investment advisers

The U.S. Treasury, through FinCEN, is set to broaden the AML regulatory framework to incorporate certain investment advisers. These advisers will be obligated to report any suspicious financial activities and provide additional client details, thus tightening the defenses against illicit use of financial services for money laundering and tax evasion.

FinCEN's move to extend AML rules underscores a proactive approach to seal regulatory loopholes. By enforcing these new requirements, the integrity of the U.S. financial system is further safeguarded, preventing the misuse of investment advisory services for illegal purposes.

FinCEN Proposes Rule to Combat Money Laundering and Promote Transparency in Residential Real Estate

FinCEN has proposed new regulations requiring certain real estate professionals to report information on non-financed residential real estate transactions to legal entities or trusts. This move is designed to increase transparency and combat money laundering by revealing the individuals behind anonymous shell companies in real estate deals. These proposed rules will not establish new anti-money laundering program requirements but will enforce reporting obligations.

The context of this initiative reflects FinCEN's ongoing efforts to integrate real estate transactions into the U.S. AML/CFT regulatory framework, aligning with the Anti-Money Laundering Act of 2020. The regulations are part of FinCEN's expanding role to include other business sectors under AML/CFT controls.

At spektr, we're here to lend a helping hand, whether you're navigating regulatory changes or ensuring compliance for your business. Reach out to us, and let's discuss how we can tailor solutions to meet your unique compliance needs!

Get in touch

Why settle for the old way?

Discover the spektr approach; reduce chaos, boost revenue through automation-led compliance.